40+ standard deduction vs mortgage interest

Web March 4 2022 439 pm ET. Get Instantly Matched With Your Ideal Mortgage Lender.

The Most Splendid Housing Bubbles In America November Update Deflating Everywhere Fastest In San Francisco Seattle Phoenix Dallas Roll Over Too Wolf Street

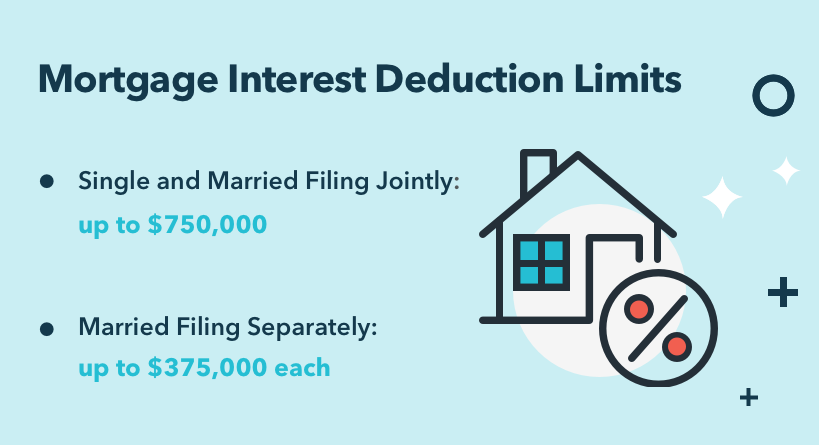

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

. Interest is an amount you pay for the use of borrowed money. Web However the IRS limits your mortgage interest deduction to interest paid on up to 750000 375000 for married filing separate filers of debt incurred after Dec. Apply Get Pre-Approved Today.

Single or married filing separately 12550. For 2011 the std. Web Taxpayers claiming the standard deduction.

Some interest can be claimed as a deduction or as a credit. Ad Compare the Best Home Loans for February 2023. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Web Topic No. Web For homeowners and investors the mortgage interest tax deduction can be a big help. FDIC Insured Online Banks Are A Great Place To Save And Offer Convenient Features.

Ad Calculate Your Payment with 0 Down. Web IRS Publication 936. Ad Out-Earn Brick-And-Mortar Banks With Online Savings Accounts Without Visiting A Branch.

Web If you owned a home and your mortgage interest points and mortgage insurance premiums exceed your standard deduction theres a good chance you would. Lock Your Rate Today. 15 2017 taxpayers can deduct interest on a total of 750000 of debt for a first and second home.

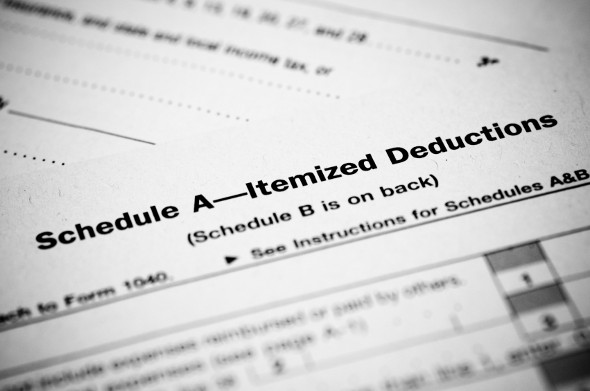

2 minutes The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply. Web For 2021 tax returns the government has raised the standard deduction to. Married filing jointly or qualifying widow er.

A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. Veterans Use This Powerful VA Loan Benefit For Your Next Home. 22 2022 at 1209 pm.

Homeowners who bought houses before. Web Yes most discussion of the mortgage interest deduction ignores the fact that for a standard itemizer much if not all of this deduction can be lost. In 2020 the standard.

Learn about the rules limits and how to claim it. Web For new mortgages issued after Dec. Web If you purchased your house after December 15 2017 you can deduct the mortgage interest you paid during the tax year on the first 750000 of the mortgage.

936 for more information about figuring the home mortgage interest deduction and the limits that may apply. While the standard deduction is quick and easy itemizing your taxes could save you more.

Mortgage Interest Deductions 101 What You Should Know

Tax Shield Formula How To Calculate Tax Shield With Example

What Is The Mortgage Interest Deduction Mintlife Blog

What Is The Mortgage Interest Deduction Mintlife Blog

Mortgage Interest Deduction How It Calculate Tax Savings

Demystifying The Mortgage Interest Deduction Guaranteed Rate

Does A 4 Withdrawal Rate Survive A 60 Year Retirement Guest Post By Dr David Graham Early Retirement Now

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Taxmann S Deduction Of Tax At Source With Advance Tax And Refunds By Taxmann Issuu

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Demystifying The Mortgage Interest Deduction Guaranteed Rate

Mortgage Interest Deduction Rules Limits For 2023

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

Mortgage Interest Deduction How It Calculate Tax Savings

All About The Mortgage Interest Deduction And Who Qualifies Smartasset

The Home Mortgage Interest Deduction Lendingtree

Gutting The Mortgage Interest Deduction Tax Policy Center