Behavioural Biases In Cryptocurrencies

Behaviour and investment satisfaction is influenced by behavioural biases and personality traits of retail investors in ICOs. Cut your losses short and let.

Pdf Users Knowledge And Motivation On Using Cryptocurrency

The disposition effect is related to loss aversion.

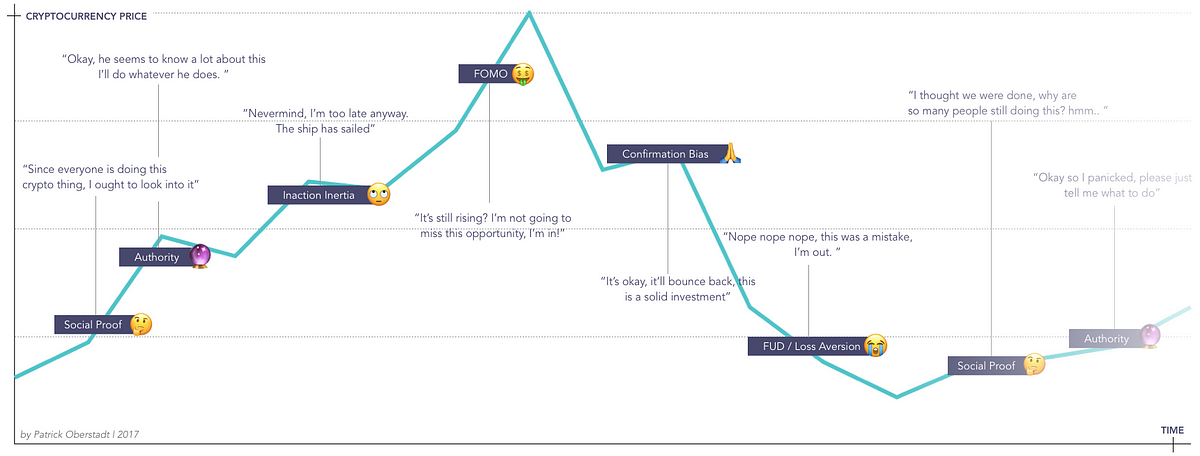

Behavioural biases in cryptocurrencies. This paper ought to fill the research gap on cryptocurrency from the behavioral perspective. Here is a complete list of all biases which are not all applicable to investing. Explain the role of these behavioural biases and how they facilitated the rise and fall of the cryptocurrency.

The Peoples Bank of China PBOC has also asked banks to cease any activities related to cryptocurrencies. A conceptual model for understanding the behavioural bias that affects investing in cryptocurrency is proposed. A conceptual model for understanding the behavioural bias that affects investing in cryptocurrency is proposed.

In the absence of complete and reliable information perceptual biases become even more exaggerated and behavior even less rational. This bias runs contrary to the timeless investing rule. There are many behavioral or cognitive biases that can influence the way you invest or the way you make decisions in general.

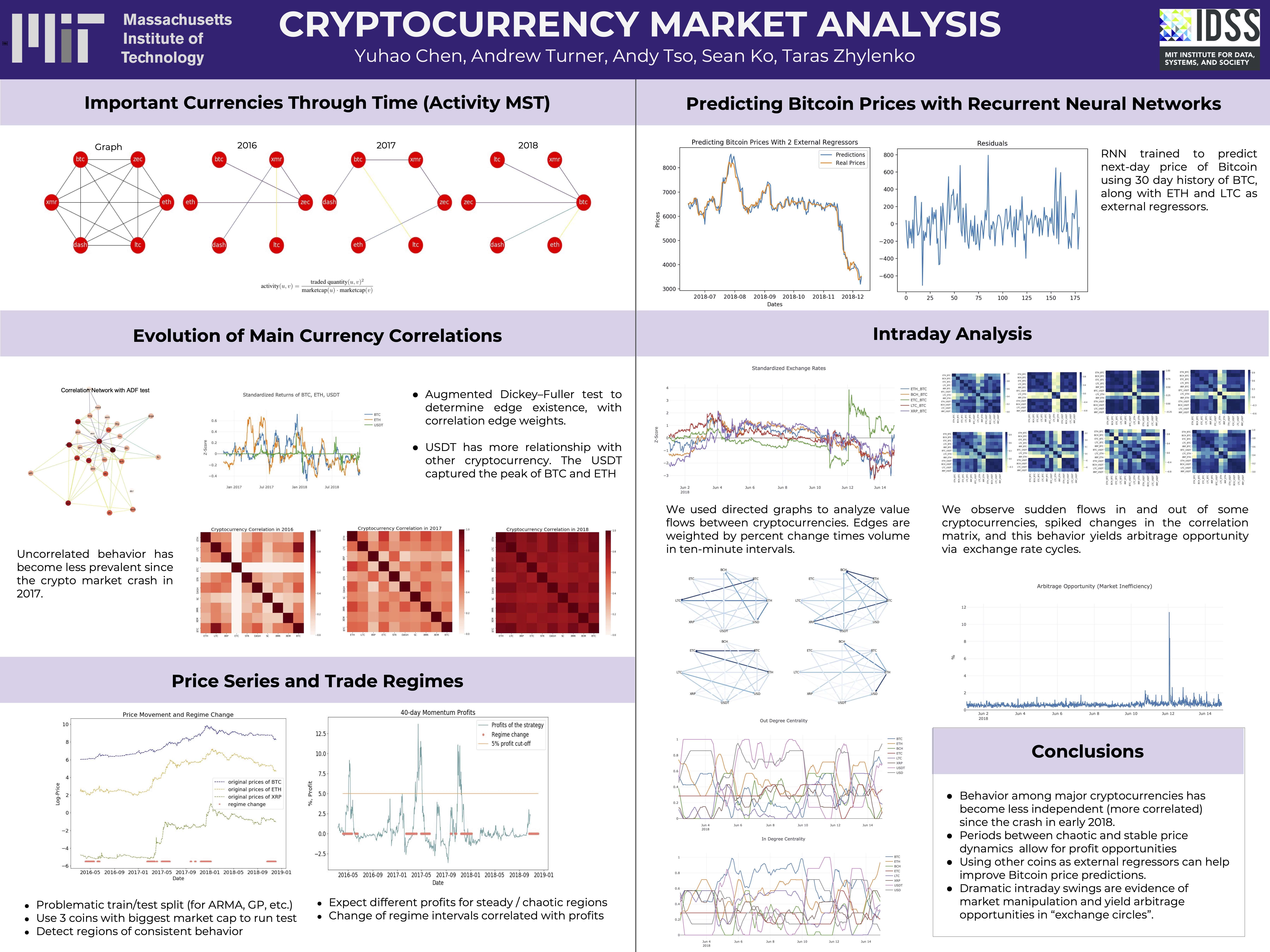

In May the government banned cryptocurrency transactions and more recently it has banned mining activities pending investigation. Balcilar Demirer Hammoudeh 2012. Herding or herd instinct is highlighted with 34 followed by confirmation only with 20 overconfidence with 17 and availability and aversion to loss with 15 and 13 respectively.

Cryptocurrency is an excellent example of this as the wildly fluctuating values are based on little more than trends and opinions shared on social media over the short term despite some cryptocurrencies offering real world value. The cryptocurrency phenomenon is better understood from a behavioral perspective one that understands the key behavioral groups involved and the motivations of each. In the continuing quest to follow the behavioral drivers in the cryptocurrency markets one cannot ignore the effect of rampant ignorance misinformation and misperception on the behavior of participants.

This is one of the behavioral biases were all very much prone to. One example was the CFA Institute Financial Newsbrief survey in 2015 of 724 investors worldwide. Investing - Behavioural biases and how they can affect your investment decisions.

The intent of this writing is to add a behavioral dimension to the current discourse on cryptocurrencies and to raise awareness of the behavioral impact on financial markets. How to identify and avoid it when trading cryptocurrencies James Edwards Posted. The biases are herding optimism overconfidence confirmation bias loss aversion and gamblers fallacy.

The biases are herding optimism overconfidence confirmation bias loss aversion and gamblers fallacy. One such asset bubble occurred in 2017 with the cryptocurrency Bitcoin as the underlying asset. Select key research results from various journal papers and books to demonstrate your understanding of these behavioural biases.

In this study the researchers provide indications of the presence of several herding and contagion effects based on a sample of 50 digital assets over. In addition provide suggestions to combat these biases. Link these biases to the event you are investigating.

Therefore it is expected that investors in the crypto market are on average inexperienced and inexperienced individual investors are also more prone to suffer from behavioural biases Chen et al 2007 p. Common Behavioral Biases In Investing. Success sometimes comes with.

Cognitive bias in cryptocurrency. The crypto market is relatively young. Underpin the conceptual model.

Many studies consider that this is the main bias of investors. Moreover herding can cause lead to explosivity in other cryptocurrencies finding evidence some emotional biases including conformity congruity of connections between those assets. The environment under pressure.

To fill this knowledge gap Da Gama Silva Gomes Klotzle Pinto have researched behavioral finance in relation to cryptocurrencies and presented their findings in the paper Herding Behavior and Contagion in the Cryptocurrency Market. Significant relationships between single biases and per-sonality traits can be found. This is important as most crypto mining takes place in China.

Another bias that comes to play while taking the path to cryptocurrency is the confirmation bias according to which humans seek research and interpret information in a way that confirms their inherent biases So people sometimes see the negative aspects of cryptocurrency which are highlighted by media suffering from its own set of biases and trying to influence public opinion such as huge price fall in a specific cryptocurrency. 16 January 2018 145 pm. And cognitive conflict home bias and gossip theories Geuder Kinateder and Wagner 2019 investigated the Almansour 2017.

We analyse survey data from more than 300 respondents finding that ICO investors are young educated and in the majority male. This allure drives investors to act without fully considering the information available to them making them prone to behavioural biases such as herding behaviour. An investor will sell a stock that has appreciated in price in order to lock in the gains on that stock while holding onto stocks that are losing money.

Infocus The Pros And Cons Of Cryptocurrency Investment Efg Asset Management

Distributed Ledger Technologies Have Potential In A Number Of Transaction Banking Products Cash Management Banking Innovation Technology

Do Investors Herd In Cryptocurrencies And Why Sciencedirect

Pdf Collective Behavior Of Cryptocurrency Price Changes

5 Behavioral Finance Biases That Hurt Investment Decisions Https Investormint Com Investing Behavioral Finance Biases Investment D Investing Behavior Finance

Code Yellow Crowd Behaviour At Highs And Lows And What The 5 Do Instead When Trading Crypto Http Qoo Ly Xgxf6 Coding Behavior Tech Stocks

Bitcoin Price 10k Holds For Now As 50 Of Cme Futures Set To Expire Https Ift Tt 2nzk1zz Bitcoin Price Bitcoin Bitcoin Business

Or Shall We Make It Plural If Everyone From Swift To Visa To Facebook To Ibm To Unbounded To Even Jp Morgan Is Going Plurals The Headlines Cryptocurrency News

Pdf Collective Behavior Of Cryptocurrency Price Changes

6 Psychological Biases You Ll Experience When It Comes To Trading Cryptocurrency By Patrick Oberstadt Crobox Medium

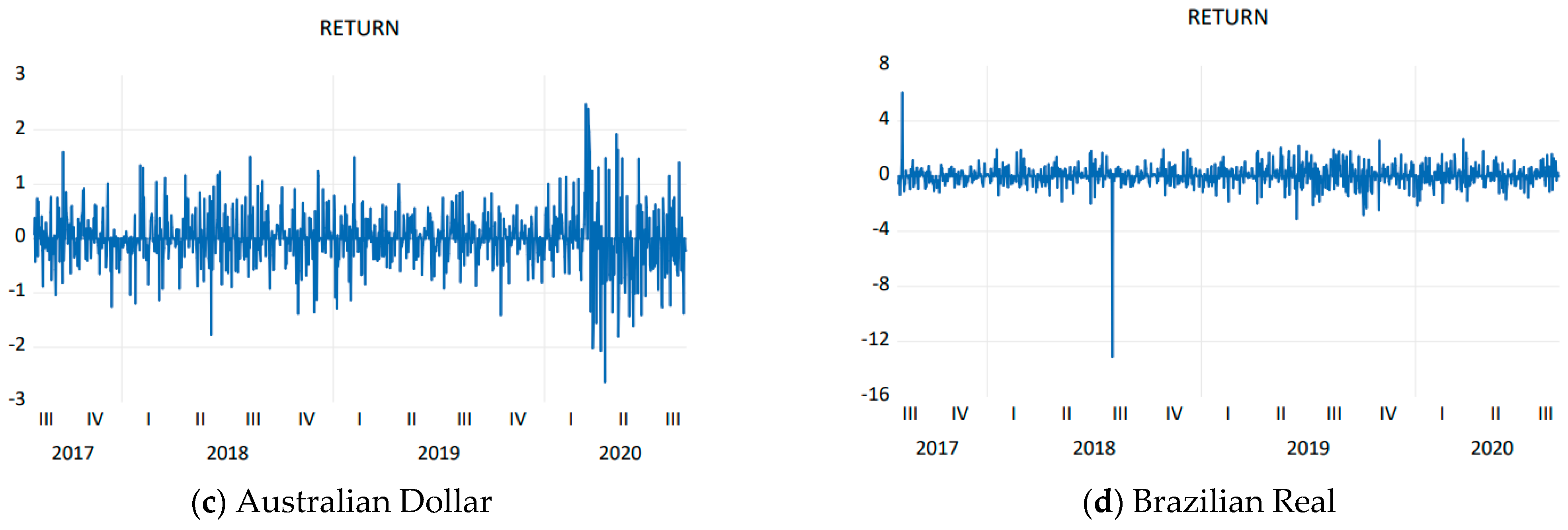

Jrfm Free Full Text A Comparative Analysis On Probability Of Volatility Clusters On Cryptocurrencies And Forex Currencies

Sallyho S Technicalanalysis 9 May 2019 Read More Http Qoo Ly Xbgcz Technical Analysis Reading Read More

Behavioural Finance How You Think When You Invest And How To Make Better Decisions Forex Trading Cool Things To Make Forex