Line of credit cost of borrowing calculator

We will charge a 5 or 10 Cash Advance Fee depending on your Billing Cycle for. If you use a credit union or lock part of the HELOC into a regular mortgage you can borrow up to 80 of the homes value.

Loan Comparison Spreadsheet Refinancing Mortgage Calculator Etsy Refinancing Mortgage Mortgage Calculator Budget Spreadsheet

The first column can be thought of as a fixed-rate home equity loan or the repayment period of a HELOC if it uses a fixed interest rate during the repayment term.

. The loan or lease decision. The first phase called the draw period is when your line of credit is open and available for use. The Student Line of Credit Amazonca Gift Card Offer the Offer is available to full and part-time undergraduate graduate and Medical or Dental Professional students enrolled in an accredited university or college in Canada or elsewhere who.

Lower cost of borrowing. You will also need a good credit history credit score of 620 or higher and a debt-to-income DTI ratio in the low 40s or lower. Whether youre renovating your home or consolidating debt a line of credit allows you to withdraw funds up to the credit limit and pay down at.

Building a good credit history. As of August 2022 a typical HELOC rate today would be around 5. Auto loan payment calculator.

Scotia RSP catch-up line of credit. The Elastic line of credit is offered by Republic Bank Trust Company. A home equity line of credit or HELOC works like a credit card.

See a sample payment schedule and how paying more than the Required Payment can reduce the cost of borrowing. Lower your overall cost of borrowing. The property must be located in a state where Regions has a branch.

The above amortizaiton tables show the interest costs and payments over a 15-year timeframe for a loan or line of credit that is fully used up to the credit limit. You can find various types of loan calculators online including ones for mortgages or other specific types of debt. A loan calculator is an automated tool that helps you understand what monthly loan payments and the total cost of a loan might look like.

A Pledged Asset Line from Schwab Bank is a flexible non-purpose line of credit¹ that lets you leverage the value of your portfolio. Actual cost of Acquisition of an Asset after considering all the direct expenses related to acquiring of asset borrowing cost and any directly attributable cost to bringing the asset to its present condition and location like Freight Insurance and Taxes. Be aware however that youll make payments on the loan during both periods.

You can withdraw as much as you want up to the credit limit during an initial draw period that is usually up to 10 years. ScotiaLine Personal Line of Credit. A HELOC is a revolving line of credit.

Rolling other debt into a secured credit line is an effective way to reduce interest costs on higher-interest borrowing particularly credit cards. Current HELOC rates 575 - 12625 APR 1. ScotiaLine Personal Line of Credit STEP ScotiaLine Personal Line of Credit for students.

There are several benefits to using a home equity line of credit especially when comparing it to other higher interest rate products such as personal loans unsecured lines of credit or credit cards. Get a 099 intro APR for 6 months then variable APR applies. The HELOC stress test.

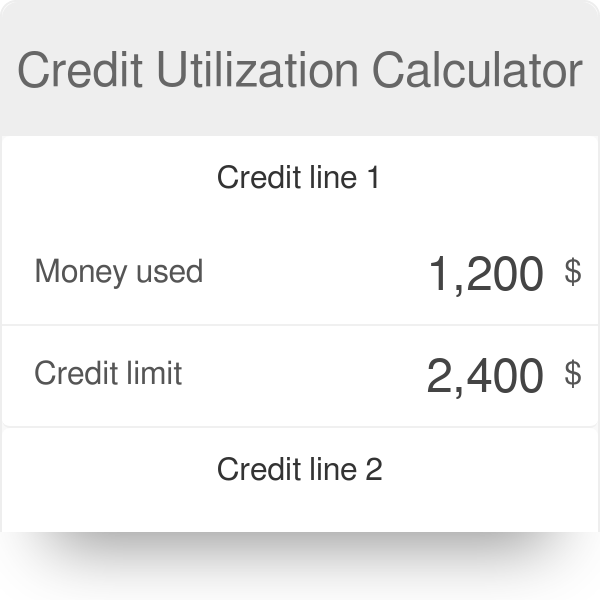

Secured by assets held in a separate Pledged Account maintained by Charles Schwab Co Inc you can use your line of credit to access the. Use our credit utilization calculator to see where your credit card utilization stands so you can start repairing your credit score if needed. Find out how much itll cost to borrow from your retirement with this easy-to-use calculator plus other ways to borrow without risking your savings.

Toggle menu toggle menu path dM526178 313114L447476 606733L741095 685435L819797 391816L526178 313114Z fillF9C32D. Line of credit calculator. Salvage Value of asset means the expected realizable value of an asset at the end of its useful.

To qualify for a HELOC youll need to have more than 15 20 equity in your home at its current appraisal value. But you arent sure of the bills youll get or the total cost. This means the principal borrowed amount can be paid off in full at any time.

Although you could potentially qualify for a credit limit of up to 65 of your homes value your real limit may be subject to a stress test similar to the mortgage stress test. A line of credit is a revolving borrowing solution that allows customers the flexibility and convenience of accessing funds to meet their diverse borrowing needs typically at a lower interest rate. A Regions Home Equity Credit Line is a flexible revolving line of credit thats secured by a primary or secondary residence.

You may be able to secure more favorable rates when applying for a mortgage or opening a new line of credit. A personal line of credit gives you more flexibility than a one-time personal loan and. B apply and are approved for a new TD Student Line of.

Loan in a Line Options. The loan calculator on this page is a simple interest loan calculator. A are of the age of majority in their province or territory of residence.

Looking to enhance your borrowing power for real estate business or college expenses. A HELOC has two phases that separate borrowing and repayment also known as the draw period and the repayment period. An unsecured line of credit or personal loan is around.

Say you have a home currently worth 300000 with a balance of 200000 on your first mortgage and your lender will allow you to access up to 85 of your homes value. Data-link-typejump-linkKeeping your credit utilization below 30 of your. Banks and other federally.

Download Loan Comparison Calculator Excel Template Exceldatapro Personal Loans Loan Excel Templates

The Loan Vs The Line Of Credit Home Equity Loans Home Equity Loan Home Equity Home Improvement Loans

Debt Consolidation Loan Investment Calculator Mls Mortgage Debt Consolidation Loans Loan Consolidation Payday Loans

Emi Calculator Loan Finance Planner Finance Planner Finance Loans Finance

Loan Amortization Schedule For Excel Amortization Schedule Loan Repayment Schedule Excel Templates

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Achieve Your Higher Education Goals Need A Loan Student Loans How To Apply

Incredible 2 Months From 2nd Of December Conventional Loan Mortgage Loans Mortgage Refinance Calculator

Auto Loan Calculator For Excel Car Loan Calculator Car Loans Loan Calculator

Credit Calculator Calculator Design Mobile App Design Calculator App

Car Loan Payment Calculator Estimate Monthly Payment Spreadsheet

Credit Utilization Calculator

Have You Tried Our Loan Calculators Yet Enter Your Desired Payment And Calculate Your Loan Amount Or Enter The Loan Amount Loan Calculator Monthly Payments

Line Of Credit Tracker Line Of Credit Personal Financial Statement Student Loan Interest

Playing With A Bank Loan Calculator Calculator Design Loan Calculator Web App Design

Home Mortgage Calculator Templates 13 Free Docs Xlsx Pdf Mortgage Amortization Calculator Line Of Credit Mortgage Calculator

Home Equity Calculator For Excel Home Equity Loan Calculator Home Equity Loan Home Equity