Cryptocurrency Cost Basis Coinbase

For simplification purposes we assume no other fees incurred. That means you can add to your basis any fees or other charges associated with the acquisition.

Can I Start Ethereum Mining Coinbase Union Pay Mode List Sman Pakusari

Later on 1 BTC was transferred to Kraken on October 15.

Cryptocurrency cost basis coinbase. There is no standard guidance from the IRS on how to apply your cost basis to individual sales or exchanges of. If you are buying or selling from 52 to 7805 the trading fee is 299 Now that weve covered the flat fees here are the variables. You can make a transaction of up to 200 within the Coinbase system if you use either your bank account or USD wallet to buy or sell cryptocurrency.

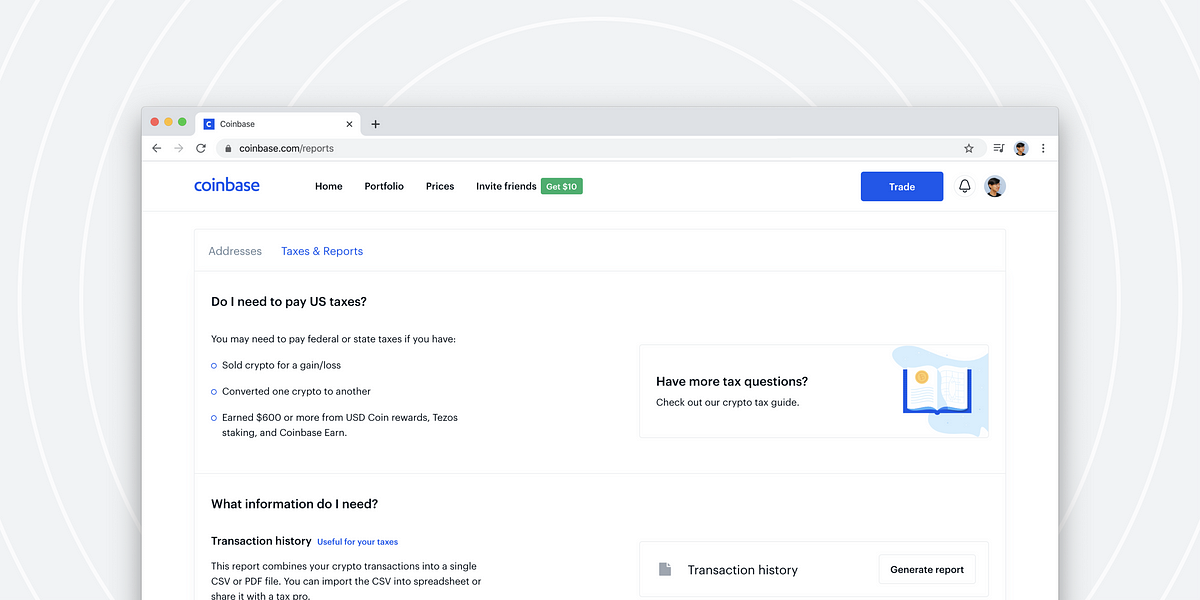

The reports you can generate on Coinbase calculate the cost basis for you inclusive of any Coinbase fees you paid for each transaction. Analyst says the new crypto tax form does not report a customers cost basis. You are a US person for tax purposes AND.

2020 for 7746 plus 05 Coinbase fees and transferred to a Ledger hardware wallet. Getting started with recurring buys on Coinbase is an effortless way to implement the DCA technique into your investment strategy. To calculate your gainslosses for the year and to establish a cost basis for your transactions we recommend connecting your account to CoinTracker.

Ive lived through more crypto crashes then I have presidents at this point and one thing I always have to remember is that setting a floor is a good thing. 1099-MISC for rewards andor fees. Your basis is the cost in dollars that you actually paid for crypto when you purchased it adjusted for any related costs.

Coinbase maintains crypto insurance and all USD cash balances are covered by FDIC insurance up to a maximum of 250000. It is used to determine your capital gainslosses incurred whenever you dispose of your crypto trade or sell. How much it cost you.

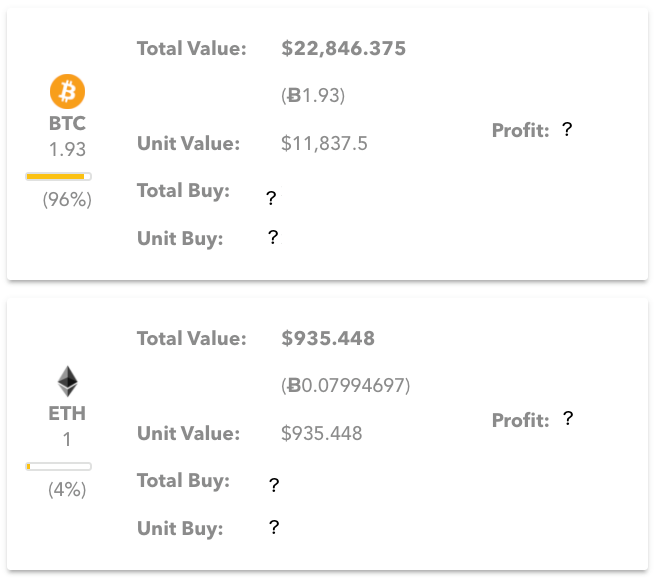

Notably the report stated that the mistake was not on the part of the crypto exchange. You may receive a 1099-MISC if. Using LIFO our cost basis or original purchase price of the 5 ETH that we sold off in June would be 2800 600 600 600 500 500.

3000 selling price - 2800 purchase price or cost basis 200 capital gain. You are a Coinbase customer AND. Cost basis includes purchase price plus all other costs associated with purchasing your cryptocurrency fees etc.

1 Bitcoin bought on Coinbase on April 28. If you buy 1 Litecoin for 250 your cost basis is 250 per Litecoin. The software connects to established cryptocurrency exchanges like Coinbase Bitstamp and others in order to track transactions in major cryptocurrencies such as BTC BCH ETH and a.

For example lets say you used Coinbase to make your crypto purchase and paid a fee of 30 to buy that 2000 of Bitcoin. Coinbase Cost Basis On Selling Bitcoin Coinbase. Click here for more information.

Adjusted Basis 7746 057746 778473. Or more specifically all costs incurred in the acquisition of the asset. From our examples above its easy to see this formula in action.

They will give you a summary of all your crypto purchases and sales along with the cost basis and capital gains. 2020 and sold for 11393. If you bought 1 Litecoin for 250 your cost basis is 250 per Litecoin.

Over time the investment costs average out. Doing the math then. If you sell or trade it when its worth 400 that 400 is the fair market value.

Learn how your crypto is covered by. A review that was carried out and reported some few weeks back showed that Coinbase allowed its users to overpay taxes due to the method of taxing it employed. If you purchase and sell a cryptocurrency on the same day using a credit card this can cost up to 9 of the total price which is quite expensiv.

Coinbase uses a FIFO first in first out method for your Cost Basis tax report. As you can see purchasing cryptocurrency on Coinbase could cost about 4 in fees per transaction which can get very expensive. Sure we all want BTC at 60k USD and ETH at 4k USD but what people never talk about is how every time we gain a new all time high we set a new all time high floor.

By investing the same amount on a regular basis you buy more crypto when the dollar value is lower and you buy less when the dollar value is higher. Put another way cost basis typically represents how much money you put into purchasing your crypto ie. Basis means cost.

Ethereum 2 0 Staking Rewards Are Coming Soon To Coinbase By Coinbase The Coinbase Blog

Buy Bitcoin With Card Uk Bitcoin Vs Ethereum Vs Litecoin Mode Grid Sman Pakusari

Coinbase Review Exchange Scam Or Not Real Test 2021

Coinbase Review Exchange Scam Or Not Real Test 2021

Bitcoin Taxes Coinbase How To Withdraw Funds From Bitfinex

Learn How To Invest The Easy Way Investing Trading Learning

Coinbase Tells You If Top Holders Are Buying Or Selling A Crypto Asset Told You So Tech Blogs How To Find Out

Price Bitcoin Versus Gold Coinbase Canceling All Ether Purchases Mode Grid Sman Pakusari

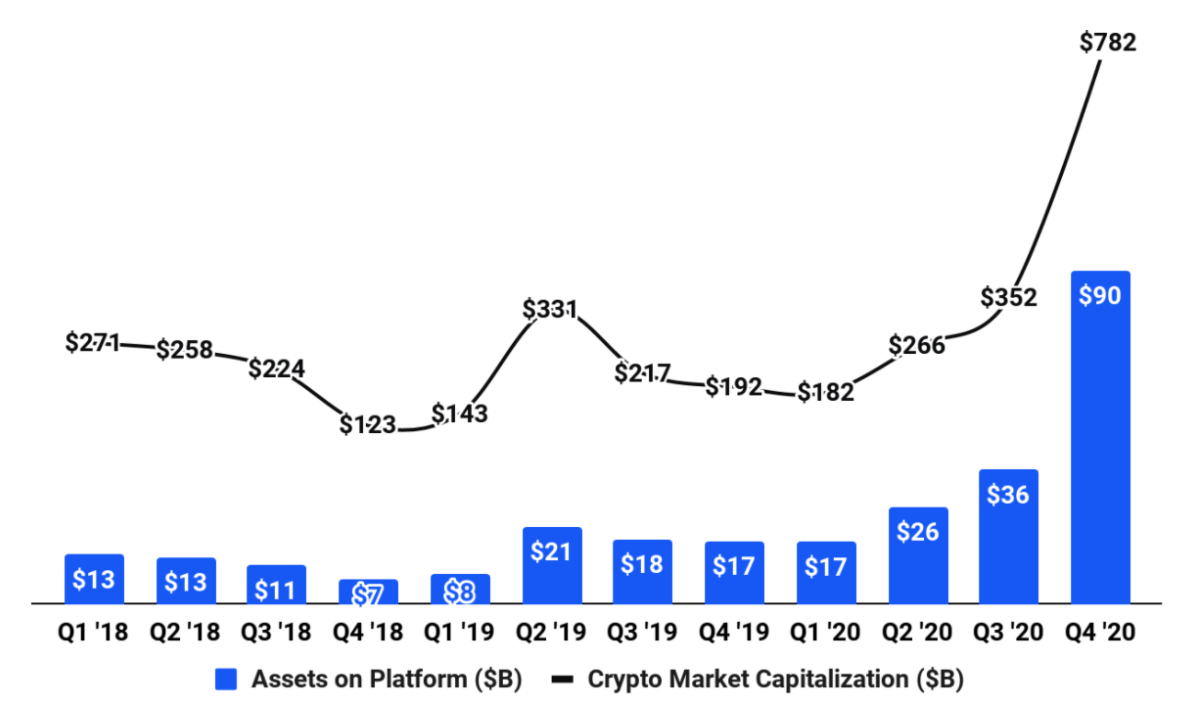

How Does Coinbase Make Money Coinbase Business Model In A Nutshell Fourweekmba

Tesla Ceo Elon Musk Supports Dogecoin Listing On Coinbase In 2021 Buy Dogecoin Tesla Ceo Doge

Coinbase Develops Bitpay Competitor Supporting Btc Bch Eth And Ltc Supportive Competitor Development

How Can We Make These Transaction Costs Lower Please I Want To Know Why Are More Institutions Networking Their Buy Cryptocurrency Transaction Cost Bitcoin

How To Calculate Losses In Bitcoin Auto Btc Trader For Coinbase Vega Mix D O O

How To Use The Coinmarketcap Portfolio Coinmarketcap

Why Coinbase S Ipo Is A Big Deal For Crypto Digital Disco

Price Bitcoin Versus Gold Coinbase Canceling All Ether Purchases Sman Pakusari

Coinbase Granted One Month Delay In Cryptsy Lawsuit Appeal Cryptocurrency Bitcoin About Me Blog

Coinbase Resources For 2019 Tax Returns By Coinbase The Coinbase Blog