Accounting Guidelines On Cryptocurrency And Tokens

Referred to as cryptocurrencies and the primary issues involved in accounting for crypto- currency holdings under Accounting Standards for Private Enterprises ASPE Standards. In the absence of formal guidance accounting for tok ens is based on the rights and obligations attached to them.

Ripple Promises Higher Clear Degree Of Accuracy For Xrp Volumes Sales Ripple Cryptocurrency News Accuracy

2 Technical Line A holders accounting for cryptocurrencies 18 October 2018 We believe that cryptocurrencies meet the definition of indefinite-lived intangible assets and holders should account for them at historical cost less impairment applying the guidance in Accounting Standards Codification ASC 350 Intangibles Goodwill and Other.

Accounting guidelines on cryptocurrency and tokens. At first it might appear that cryptocurrency should be accounted for as cash because it is a form of digital money. For the purposes of this practice aid digital assets are defined broadly. As businesses invest funds in cryptocurrencies and sell assets like nonfungible tokens they should be aware of the accounting and tax issues surrounding them or risk running afoul of regulators.

For accounting purposes cryptoassets could be classified as i cryptocurrencies which are designed as a general-purpose medium of exchange sharing the characteristics of traditional currencies and ii tokens which add functionality to the holder such as the right to receive certain goods or services. Cryptocurrency oferings such as initial coin oferings and initial token ofer ings are gaining traction in the global fnancial markets with over US5 billion raised to date as of December 31 2017. And the truth is that while you did not have to understand the full cryptocurrency process if you are a holder it would be great to understand it for miners.

However current accounting standards do provide guidance that can be applied to most crypto-assets. This method of accounting is simple flexible and closely follows IRS guidelines. 4 An Introduction to Accounting for Cryptocurrencies.

Tax and accounting treatment for companies paying employees in crypto-assets. Consideration should also be given to the entitys purpose for holding the cryptographic assets to determine the accounting model. Below are four key practices to think through when starting your ICO.

One exception would be commodity broker-dealers buying or selling cryptocurrencies within the normal course of business. There is no current specific guidance on the accounting for crypto-assets and as yet no clear industry practice. The accounting for digital assets is an emerging area and so far neither the FASB nor the IASB have provided specific accounting guidance.

Accounting advice for typical crypto-asset businesses such as cryptocurrency exchange platforms custodian wallet providers and Bitcoin ATMs. If you run a small business or a startup that accepts cryptocurrencies as a form of payment there are two primary situations where you will have to report income on your books under the cash basis of accounting. Cryptocurrencies and digital tokens challenge traditional financial reporting boundaries.

There is cur rently no specific accounting guidance on other cryptoassets such as tokens. Accounting treatment of cryptocurrencies and tokens. It is fair to say that accounting for cryptocurrency under the aforementioned measurement criteria in the current volatile market would not provide useful information to users of financial statements.

IFRIC s proposals deal only with cryptocurrencies. Cryptocurrency carries a degree of anonymity since it doesnt require users to give up any secret information. Companies need to be careful with accounting for crypto.

In order to run and maintain a successful ICO companies need careful and consistent accounting practices and a consistent plan for token and finance management. Standard payment methods like credit cards require customers to share their name address card number expiration date and CVS number. This guidance is intended for financial statement preparers and auditors with a fundamental knowledge of blockchain technology.

What accounting standards might be used to account for cryptocurrency. With corporations like MicroStrategy investing billions of dollars in cryptocurrencies more. For example depending on the nature of the underlying asset you might account for them as-.

IFRS Accounting for crypto-assets 5 22. However cryptocurrencies cannot be considered equivalent to cash currency as defined in IAS 7 and IAS 32 because they cannot readily be exchanged for any good or service. When sell your product and receive cryptocurrency.

As the technology continues to evolve it may not be clear how to apply accounting requirements to these transactions. In contrast to cryptocurrency which is designed as a general-purpose medium of exchange across applications tokens tend to be designed to support a more narrowly-defined. Consideration of tax implications when the entity issuing the cryptocurrencies or token in.

Accounting for cryptocurrencies by miners While holders received some guidance from IFRIC there is literally no guidance on accounting for cryptocurrencies by their miners. Tokens crypto-assets other than cryptocurrencies We use tokens as an umbrella term for a wide variety of crypto-assets. This publication also includes a brief summary of some of the tax implications of invest-.

Income From Tokens is Still Income. On the basis of current accounting frameworks and specifically in the light of IFRS Standards it is unclear how crypto assets including cryptocurrencies and digital tokens should be accounted for. Our views on what the appropriate treatment could be for the four categories of crypto-assets are as follows.

IFRS does not include specific guidance on the accounting for cryptographic assets and there is no clear industry practice so the accounting for cryptographic assets could fall into a variety of different standards. Token income is no different than Kickstarter income. Securities regulators have raised con-.

Baidu Provides Xuperchain Blockchain To Industries In Hainan Province China Blockchain Blockchain Cryptocurrency Blockchain Technology

Account Suspended Blockchain Small Scale Business Contract Management

Grayscales Stellar Lumens Xlm Investment Trust To Lure Burned Crypto Investors Stellar Lumens Investing Cryptocurrency Market Capitalization

Cryptoreporter Com On Twitter Cryptocurrency Compensation Ico

Smartphone With Bitcoin Trading Chart Vector Trading Charts Cryptocurrency Bitcoin

5 Portals That Rate And Rank Defi Projects For You Where To Invest Plate Tectonics Lists To Make

In May Two Groups Teamed Up To Force A Compromise That Would Push Past The Stalemate But Left Out Of A C Cryptocurrency Investing In Cryptocurrency Blockchain

New Crypto Coin With 1000x Potential Massive Gains Ahead New Crypto Coins Crypto Coin Potential

Chamber Of Digital Commerce Proposes Guidelines For Responsible Crypto Market Growth Investing In Cryptocurrency Crypto Market Cryptocurrency

Cryptocurrency S Accounting Problem

Ethereum Smart Contract Testing Guidelines Https Www Paxos Com Ethereum Smart Contract Testing Guidelin Business Logic Integration Testing Testing Strategies

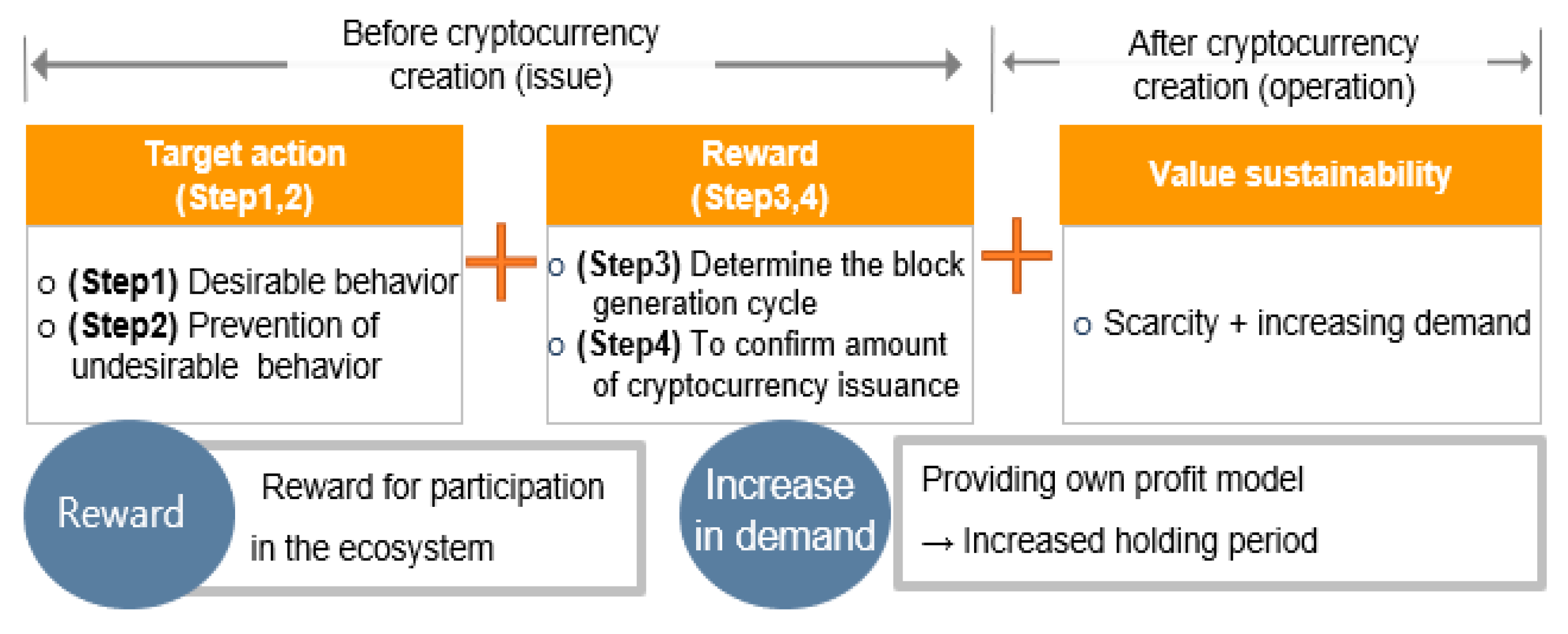

Jrfm Free Full Text How To Design Cryptocurrency Value And How To Secure Its Sustainability In The Market Html

Total Reward Get 10 Usdt When You Register At Coincasso Exchange Complete Easy Kyc Create An Account At Coin In 2021 Crypto Currencies Digital Wallet Exchange

Binance Backed Swipe Partners With Kava To Foster Usdx Defi Ecosystem Btcmanager Fiat Money Ecosystems Goods And Services

Cryptocurrency Taxation How To Take A Step Forward Inter American Center Of Tax Administrations

Bitcoin Commemorative Coin With Showcase Box And Plastic Round Display Case Set Cryptocurrency Coin For Hodl Fans Btc Novelty Physical Token Coins Are A Goo Commemorative Coins Display Case

Pin On Cryptocurrency Opportunity Kuvera

Pdf Tokens Types And Standards Identification And Utilization In Ethereum